Description

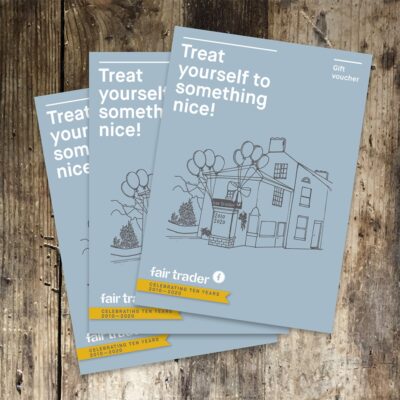

Fair Trader Membership – Become a member of Fair Trader – minimum investment £20.

IMPORTANT – READ BEFORE APPLYING FOR MEMBERSHIP

-

Decide how many shares at £20 you wish to buy. You can buy a minimum of one up to a maximum of 1000 shares.

-

If purchasing on behalf of a company, please contact us.

-

Once you have purchased your shares, you will receive an order confirmation by return email. We will then send your Share certificate and welcome pack by post.

In purchasing membership shares online, you are confirming that you are agreeing to the following:

- I am 16 years of age or above and live in the UK.

- I have read and understood the Terms and Conditions of Membership.

Membership Terms & Conditions

Warning: Money invested in shares is fully at risk

The following describes the share offer in some detail including the legal structure, shareholders rights, investment risks, the purpose for which the capital is being raised, and the envisaged financial and social returns.

1. The Fair Traders Co-operative Limited (Trading as ‘Fair Trader’) is established as an Industrial and Provident Society (Registration Number 30710R) and is a community co-operative.

Membership is open to any person or corporate body:

- who supports the aim of the Society

- who purchases at least one share (£20)

- whose application for membership is approved by the Management Committee.

No one member may hold more than 20% of the total shares issued by the Co-operative. Every member shall hold one vote only on each question to be decided, regardless of how many shares he/she holds. The purpose of the continuing share offer is to build a loyal and committed membership base and to raise additional funds to underpin the growth of the business.

2. The primary aims of The Fair Traders Co-operative are:

To provide sustainable small suppliers, particularly co-operatives, with a direct, supportive, retail (bricks and mortar, and internet) and wholesale partner; and thereby help disadvantaged communities

- To offer customers an increasing range of ethical products that have been assessed in terms of their sustainability and offer good value

- To foster intelligent consumerism by encouraging interaction and debate over both impact assessments and improvement priorities.

It is not the aim to make large returns on capital invested. Although our rules allow a dividend of up to 10% per year, we intend to restrict dividends and instead apply any surplus to furthering our primary aims as detailed above. The Directors will recommend what interest, if any, should be paid on share capital and this will be voted on at the Annual General Meeting. The society has paid no interest since starting due to accumulated losses. Interest, if paid, is paid gross and is taxable. It is your responsibility to declare any such earnings to HMRC if applicable. Interest will be credited to your share account and be subject to the same period of withdrawal as all share capital. If you have reached the maximum permissible shareholding, you will be paid the excess balance.

3. The purchase of shares will entitle a person to be a full member of the co-operative, to attend and vote at general meetings of the Society, to stand for election to the Committee of Directors and to inspect the share register.

4. Money invested in shares is fully at risk. If the Society fails, shareholders may lose some or all of the money invested. Before investing you should be clear about the key risks. For information, you can download a copy of the most recent Directors’ Report and Accounts below. If you would like details of earlier years’ accounts, the Society Rules or any other relevant information, please contact the Society Secretary by emailing info@fairtrader.coop

5. The minimum shareholding for membership is one £20 share. The Directors set the minimum investment at a level which is designed explicitly to encourage people to become members and is felt to be affordable. It is not possible for the co-operative to issue shares to a value of more than £20,000 per member.

6. Due care has been taken in preparing this offer document which has been overseen by the Directors. We vouch that the information contained herein is in accordance with the facts and that there are no omissions likely to affect its validity.

7. Shares are ordinary withdrawable shares and are not transferable. You cannot sell/transfer your shares to another person. Shares will only be redeemed at face value by the Co-operative in accordance with its Rules. However, our investors will enjoy seeing considerable social returns on their investment. The Committee have currently suspended the right to withdraw shares under rule 10(d) due to the demands on the Society’s capital. In any event if more than 10% of the total share capital of the co-operative shall be under notice of withdrawal in any one calendar year the right to withdrawal may be suspended by the Committee. Thirteen weeks notice shall be required of any withdrawal.

8 . The Committee of Directors has the right to write down the value of the shares if the liabilities of the co-operative exceed its assets. Members applying to withdraw their shares in this period would receive only the written down value of their shares.

9. In the event of the Co-operative ceasing to trade members will be paid up to a maximum of £20 for each £20 share owned once all the creditors have been paid in full. In the event that the Co-operative cannot pay its creditors in full members may lose some or all the value of their shares.

10. This proposal is not regulated by the Financial Services and Markets Act 2000 because the shares in the Co-operative are not ‘securities’ for the purpose of those regulations. It is therefore not authorised by the Financial Services Authority. If the business fails you have no right of complaint to the Financial Ombudsman or the Financial Services Compensation Scheme.

11. If you are in any doubt about your investment you should consult an Independent Financial Advisor authorised under the Financial Services and Markets Act 2000.